We have been included in VouchedFor’s 2025 Top Rated Financial Adviser Guide, distributed in The Times.

The importance of diversifying your investment portfolio

Top Rated Advice

Our Locations

We have five local offices and can help if you are looking for a:

Financial Adviser in Edinburgh

Financial Adviser in Falkirk

Financial Adviser in Glasgow

Financial Adviser in Livingston

Financial Adviser in Stirling

If you would like to speak to an Independent Financial Adviser (IFA) then book your free initial consultation.

What is portfolio diversification?

Diversification is a key principle of investing that can help to reduce risk and increase returns. In simple terms, diversification means spreading your money across a variety of different assets, such as stocks, bonds, and property, rather than putting all of your eggs in one basket. When it comes to investing, diversification can help to protect you against market volatility and unexpected events.

For example, if you only invest in a single stock and that stock performs poorly, your entire investment portfolio will suffer. However, if you diversify your portfolio by investing in a variety of stocks, bonds, and other assets, the impact of a single poor-performing investment will be lessened.

Components of a diversified portfolio

There are several ways to diversify your portfolio, including:

Asset allocation: This is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, property and cash.

Sector diversification: This is the process of spreading your investments across different sectors of the economy, such as technology, healthcare, and financial services.

Geographical diversification: This is the process of spreading your investments across different countries and regions.

Bond diversification: This is the process of spreading your investments across different types of bonds, such as government bonds, corporate bonds, and high-yield bonds.

Tip: Another important aspect of diversification – particularly if you are investing in actively managed funds – is spreading your investments across different investment funds or managers. By investing in a variety of funds or managers, you can reduce the risk of your portfolio being affected by the performance of a single fund or manager.

Different funds may have different investment strategies, risk levels, and charges. By investing in a variety of different funds, investors can gain exposure to a wide range of assets and investment strategies.

Importance of financial advice

A financial adviser can help you to create a diversified portfolio that aligns with your investment goals and risk tolerance. They can also help you to monitor and rebalance your portfolio as needed to ensure that it doesn’t stray into a different risk category than originally intended and assess the performance of the individual funds to see if they should remain in the portfolio or be replaced – and if so, identify suitable replacements.

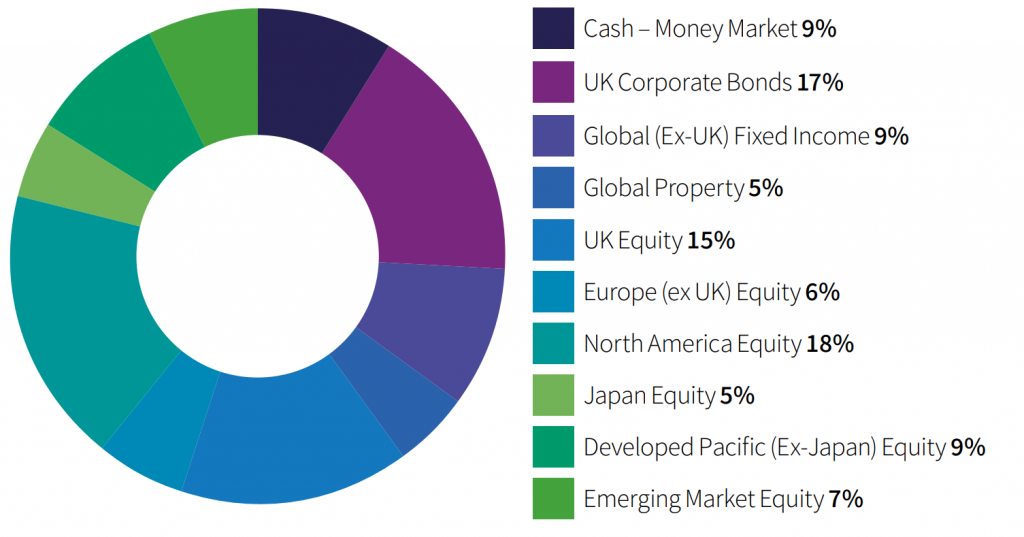

At Select Wealth Managers we constantly keep our asset allocation models under review. At the time of writing, if a client was investing for growth, had no plans to access the money within 5 years, and agreed to a risk level 5 – Balanced, on a scale of 1-10, the pie chart below shows our starting point for asset allocation.

Balanced Investor Profile: As a Balanced investor you do not see yourself as a particularly cautious person and have no strong positive or negative associations with the notion of taking risk.

If you have some experience of investments and a degree of understanding of financial matters then you may be suited to a Balanced approach to investing.

You may also be suited to this approach if you make investment decisions reasonably quickly and don’t tend to be particularly anxious about those decisions.

As a Balanced investor you can be inclined to look for a combination of investments with differing levels of risk and understand that you may need to take some risk to meet your investment goals.

Our next step in putting together an investment portfolio would be to discuss factors such as investment preferences, ethical considerations, and charges. For this example, we have assumed the client had no ethical considerations, wanted to keep costs below 1% per year and generally favours active fund management.

A portfolio that meets these objectives is as follows:

The chart and table below show the asset allocation of this portfolio of funds:

(1) Due to rounding there may be a discrepancy between the Long/Short % and the Net %.

Finally, the graph below shows the past performance of this portfolio of funds (with the caveat that past performance is not a guide to the future):

Source: Defaqto. The chart shows an investment’s performance, calculated as NAV to NAV/Bid to Bid/Closing Price to Closing Price, with dividends/distributions reinvested, including the effect of ongoing costs and charges. These figures are calculated to the performance date 19 January 2023.

Summary

It is important to note that diversification does not guarantee a profit or protect against loss. It is also important to understand that diversification alone may not be enough to meet your investment goals, it is only one component of an overall risk management strategy.

The above chart shows that this diverse portfolio has delivered strong returns however when Covid hit the markets in 2020 the portfolio dropped a large amount, similarly 2022 was the worst year for equity markets since the 2008 Financial Crash and again, diversification would not have prevented a significant drop in fund value.

To summarise, diversification is a key principle of investing that can help to reduce risk and increase returns. By spreading your money across a variety of different assets, such as stocks, bonds, and property, you can protect yourself against market volatility and unexpected events.

A financial adviser can help you to create a diversified portfolio that aligns with your investment goals and risk tolerance. They can also monitor and rebalance it over time to ensure it remains suitable. We would always recommend that you seek professional advice before making any investment decisions.

We revisited this portfolio in January 2024 – click here to read

This information is based on our current understanding and is subject to change without notice. This article is for general information only and does not constitute advice. Whilst information is considered to be true and correct at the date of publication, changes in circumstances, regulation and legislation after the time of publication may impact on the accuracy of the article.

The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

We have local offices in Edinburgh, Falkirk, Glasgow, Livingston and Stirling and provide Financial Advice throughout Scotland. If you would like to speak to an Independent Financial Adviser (IFA) then book your free initial consultation.

Sean Gilbert

Chartered Financial Planner

Chartered Financial Planner at Select Wealth Managers with 14 years of Financial Services experience. Before working in Financial Services, Sean…

HOME

Go back to the home page

ABOUT US

Find out more about us

OUR SERVICES

View the services we offer